To face the shortage of semiconductors which agitates the world since 2020, the companies of the sector and in particular the leaders TSMC, Intel, Samsung, have massively invested in additional means of production. The problem is that the suppliers of the necessary machines are themselves afraid of running out of chips to meet this explosion in demand. The trade association Semiconductor Equipment and Materials (SEMI) sounds the alarm in a blog post published on May 2.

Too many new plants and not enough suppliers

The chip shortage is not over. The most optimistic companies, who were aiming for a return to balance between supply and demand during 2022, no longer really believe in it. Pat Gelsinger, CEO of Intel, one of the three largest semiconductor manufacturers, recently admitted that he does not see the situation improving until 2024.

In an attempt to address the global chip shortage, construction of new factories has exploded. Between 2020 and 2024, 86 factories are scheduled to break ground and begin production. While this number may seem paltry, it is actually enormous.

Each factory easily costs tens and tens of millions of dollars, for the largest the unit of measurement is more like billions of dollars: the construction of a state-of-the-art mega manufacturing site in Germany will cost 17 billion dollars to Intel. In Japan, TSMC plans to build a factory for about 6 billion dollars.

These investments trickle down to the suppliers of these giants. Global equipment sales could exceed $100 billion by 2022. Sanjay Malhotra, vice president of SEMI and a 25-year veteran of the industry, told the Wall Street Journal, ” Five or six years ago, I would have said that $75 billion was a stretch “.

Of course, there are not all positives in this semiconductor race. The suppliers are not not always able to keep pace. The average time to get the machines needed to make the chips has increased from 3-6 months in 2020 to 14 months in July 2021. In some specific cases, the queue exceeds two years.

And the snake eventually bites its own tail. Ajit Manocha, CEO of SEMI, fears that suppliers will themselves be affected by the chip shortage and will no longer be able to provide the machines to make them. He urges governments and industry to ” Guarantee the supply of the necessary chips to suppliers ” to be able to ” build the essential tools for the rise of the new factories “.

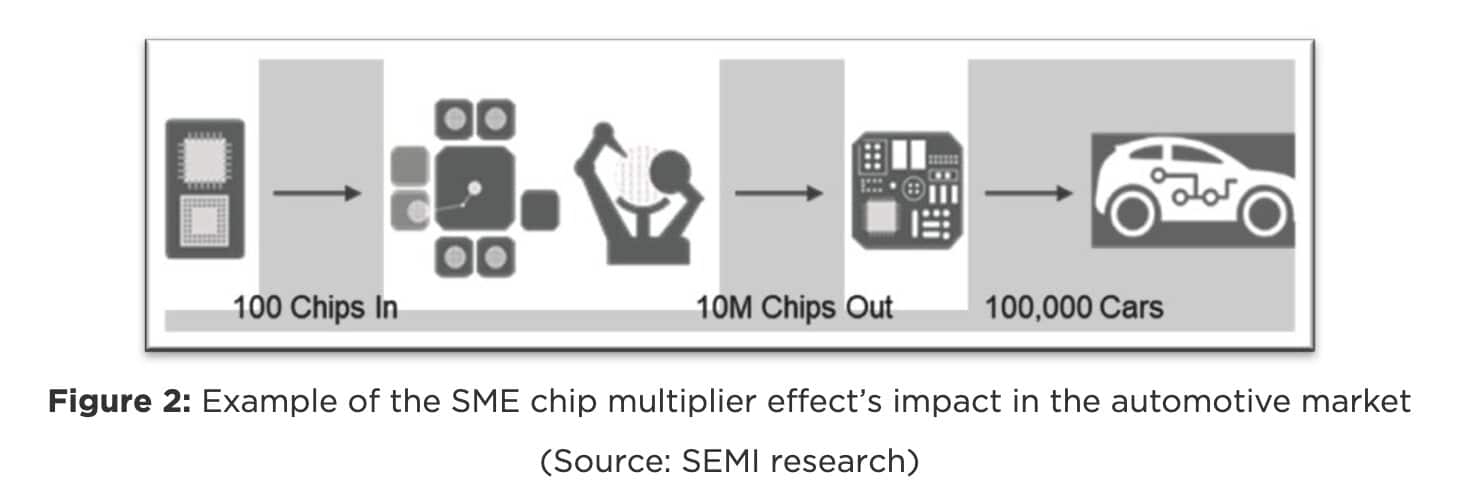

By dint of schematics he explains that these suppliers, 1% of the world market, will greatly improve the supply of tools and thus make more semiconductors.

Schematic proposed by SEMI to support its priority procurement request.

Flea, where are you?

A shortage of chips would add to the difficulties of a sector that is already experiencing problems in supplying itself with chemicals, mainly produced in Ukraine and Russia, a shortage of silicon substrates that connect chips to printed circuits, a difficulty in hiring…

At the same time, the general demand for semiconductors is not waning. The peak in computer purchases that occurred during the health crisis in 2020 has subsided, but at a still high level. The proliferation of connected electronic devices, electric vehicles and industrial automation systems will continue to create a strong need for chips for a long time to come.

On the equipment supplier side, ASML Holding NV, a Dutch company known for making some of the most advanced and expensive tools on the planet, is trying to produce more, with the help of its customers. However, it does not expect to be able to do so before 2025…

.